Problem

Many employees feel frustrated when they see how much of their salary is lost to tax deductions. Despite earning a decent salary, their take-home pay is significantly reduced due to statutory deductions like PAYE (Pay-As-You-Earn) tax and pension contributions.

What if there was a way to increase employees’ take-home pay without increasing their gross salary?

Most businesses unknowingly structure payroll in a way that maximizes deductions instead of optimizing earnings for employees.

The Psychology of Employee Compensation

Understanding how employees perceive their earnings is crucial for structuring payroll in a way that maximizes satisfaction and retention. Many companies focus on offering higher gross salaries, but employees are more concerned with their take-home pay—the amount they actually receive after deductions.

Why Take-Home Pay Matters More Than Gross Salary

- Employees budget and plan their finances based on net pay, not gross salary.

- A high salary with excessive deductions can reduce morale if employees feel they are not earning enough.

- Unexpected tax deductions and low pension contributions can negatively impact long-term financial well-being.

How Payroll Structuring Affects Employee Satisfaction

- Employees are more engaged when they feel they are being fairly compensated.

- Reducing unnecessary deductions while staying compliant creates a win-win for both employer and employee.

- Strategic payroll structuring can increase retention, productivity, and overall workplace satisfaction.

Strategies

Smart payroll structuring can legally increase employees’ take-home pay while keeping the company compliant. Many organizations overpay taxes and underutilize payroll structuring strategies that could legally improve employees’ take-home pay. Below are three major strategies that can help businesses boost employee earnings while staying compliant.

- Improve Employee Take-Home Pay Through Reimbursement

Reimbursements are not subject to tax deductions, making them a powerful tool for increasing take-home pay.

Instead of paying all compensation as taxable income, businesses can structure part of the pay as reimbursable allowances for work-related expenses (e.g., wardrobe, meals, utilities).

Since reimbursements are non-taxable, employees get more money in hand without additional tax burdens.

- Reduce Tax Bill Through Reimbursement

When allowances like meal, utility, and wardrobe are structured as reimbursable expenses, they are excluded from taxable income.

This lowers the total taxable salary, reducing PAYE tax deductions while keeping employees financially comfortable. Instead of offering allowances that are taxable, reimbursements ensure employees receive more money without deductions.

Example: An employee receiving a N120,000 meals allowance will have taxes deducted from it. However, if 50% is structured as a reimbursement, they can receive the 50% of the amount without tax deduction.

This strategy legally minimizes tax obligations while maximizing net pay.

- Improve Pension Contributions Without Affecting Take-Home Pay

Pension contribution is calculated on Basic, Housing, and Transport allowances, which means structuring payroll incorrectly could reduce long-term pension savings.

If reimbursements are taken from other allowances (such as Meal, Utility, or Wardrobe), employees can still enjoy a higher pension contribution without reducing their immediate take-home pay.

By keeping these components intact while shifting other allowances to reimbursements, employees can benefit from both higher pension contributions and increased take-home pay.

Example Calculation

Let’s say an employee has a monthly gross salary of N100,000, with the following breakdown:

| Allowances | Percentage | Monthly Allowance | Annual Allowance |

| Basic Salary | 35% | ₦35,000 | ₦420,000 |

| Housing Allowance | 20% | ₦20,000 | ₦240,000 |

| Transport Allowance | 15% | ₦15,000 | ₦180,000 |

| Meal Allowance | 10% | ₦10,000 | ₦120,000 |

| Utility Allowance | 10% | ₦10,000 | ₦120,000 |

| Wardrobe Allowance | 10% | ₦10,000 | ₦120,000 |

| Total Gross Salary | 100% | ₦100,000 | ₦1,200,000 |

Standard Payroll Calculation Without Optimization:

- Compute Annual Pension (8% of Basic + Housing + Transport)

- 8% of (420,000 + 240,000 + 180,000) = 8% of 840,000 = ₦67,200

- Compute Gross Income for CRA (Annual Gross Income – Pension)

- ₦1,200,000 – ₦67,200 = ₦1,132,800

- Compute Consolidated Relief Allowance (CRA), (Higher of N200,000 or 1% of Gross income for CRA + 20% of Gross income for CRA)

- Fixed Consolidated Relief Allowance = ₦200,000

- Variable Consolidated Relief Allowance = (20% x 1,132,800) = ₦226,560

- Total Consolidated Relief Allowance (CRA) = ₦426,560.

- Total Tax Relief = ₦426,560 + ₦67,200 = ₦493,760

- Compute the Taxable Income (Gross Income – CRA)

- ₦1,200,000 – ₦426,560 = ₦706,240

- PAYE Tax Calculation Using Tax Bands

- Estimated Annual PAYE 🟰 ₦69,936

- Divide the Annual PAYE by 12 to get the monthly PAYE of ₦5,828

- Compute the Monthly Net Pay (Monthly Gross Pay – Monthly PAYE – Monthly Pension)

- ₦100,000 – ₦5,828 – ₦5,600 = ₦88,572

Optimized Payroll Using Reimbursement Strategy:

Step 1: Identify the Allowances Eligible for Reimbursement

- Meal Allowance: ₦120,000

- Utility Allowance: ₦120,000

- Wardrobe Allowance: ₦120,000

- Total Allowances Eligible for Reimbursement = ₦120,000 + ₦120,000 + ₦120,000 = ₦360,000

Step 2: Compute the 50% Reimbursed Amount

- 50% of ₦360,000 = ₦180,000

- This amount is excluded from taxable income since reimbursements are not subject to PAYE.

Step 3: Recalculate the Annual Gross Pay with Reimbursement

- Previous Annual Gross Pay: ₦1,200,000

- Previous Monthly Gross Pay: ₦100,000

- Annual Reimbursement Deduction: ₦180,000

- Monthly Reimbursement Deduction: ₦15,000

- New Taxable Annual Gross Pay = ₦1,200,000 – ₦180,000 = ₦1,020,000

- New Taxable Monthly Gross Pay = ₦100,000 – ₦15,000 = ₦85,000

Step 4: Compute Gross Income for CRA (New Calculation)

- Gross Income = ₦1,020,000

- Pension (on Basic, Housing, Transport) remains: ₦67,200

- New Gross Income for CRA = ₦1,020,000 – ₦67,200 = ₦952,800

Step 5: Compute New Consolidated Relief Allowance (CRA)

- Fixed CRA = ₦200,000

- Variable CRA = 20% x ₦952,800 = ₦190,560

- Total CRA = ₦200,000 + ₦190,560 = ₦390,560

- Total Tax Relief = Total CRA + Pension = ₦390,560 + ₦67,200 = ₦457,760

Step 6: Compute the New Taxable Income

- Taxable Income = Gross Income – Tax Relief

- ₦1,020,000 – ₦457,760 = ₦562,240

Step 7: Compute the New PAYE (Using Tax Table)

- First ₦300,000 @ 7% = ₦21,000

- Next ₦262,240 @ 11% = ₦28,846.40

- New Annual PAYE = ₦49,846.40

- New Monthly PAYE = ₦49,846.40 ÷ 12 = ₦4,154

Step 8: Compute New Monthly Net Pay

- Monthly Gross Pay Without Reimbursement = ₦85,000

- Monthly PAYE = ₦4,154

- Monthly Pension = ₦5,600

- Net Pay = ₦85,000 – ₦4,154 – ₦5,600 = ₦75,246

- Plus Monthly Reimbursement (₦180,000 ÷ 12) = ₦15,000

Final Monthly Take-Home Pay = ₦75,246 + ₦15,000 = ₦90,246

Difference & Benefit:

- Take-home pay increased from ₦88,572 to ₦90,246 per month

- This method legally reduces PAYE and increases employee earnings

- Lower tax burden for employees

Result:

- Higher Take-Home Pay: Employees take home more money every month without increasing their gross salary.

- Lower Tax Deductions: Employees pay less in taxes legally, keeping more of their earnings.

- Better Long-Term Benefits: Pension contributions remain strong, ensuring financial security for employees in retirement.

- Employer-Employee Win: Businesses attract and retain top talent by optimizing payroll in favor of their employees.

📅 Book a Free Consultation, if you want to learn how to automate the payroll computation above.

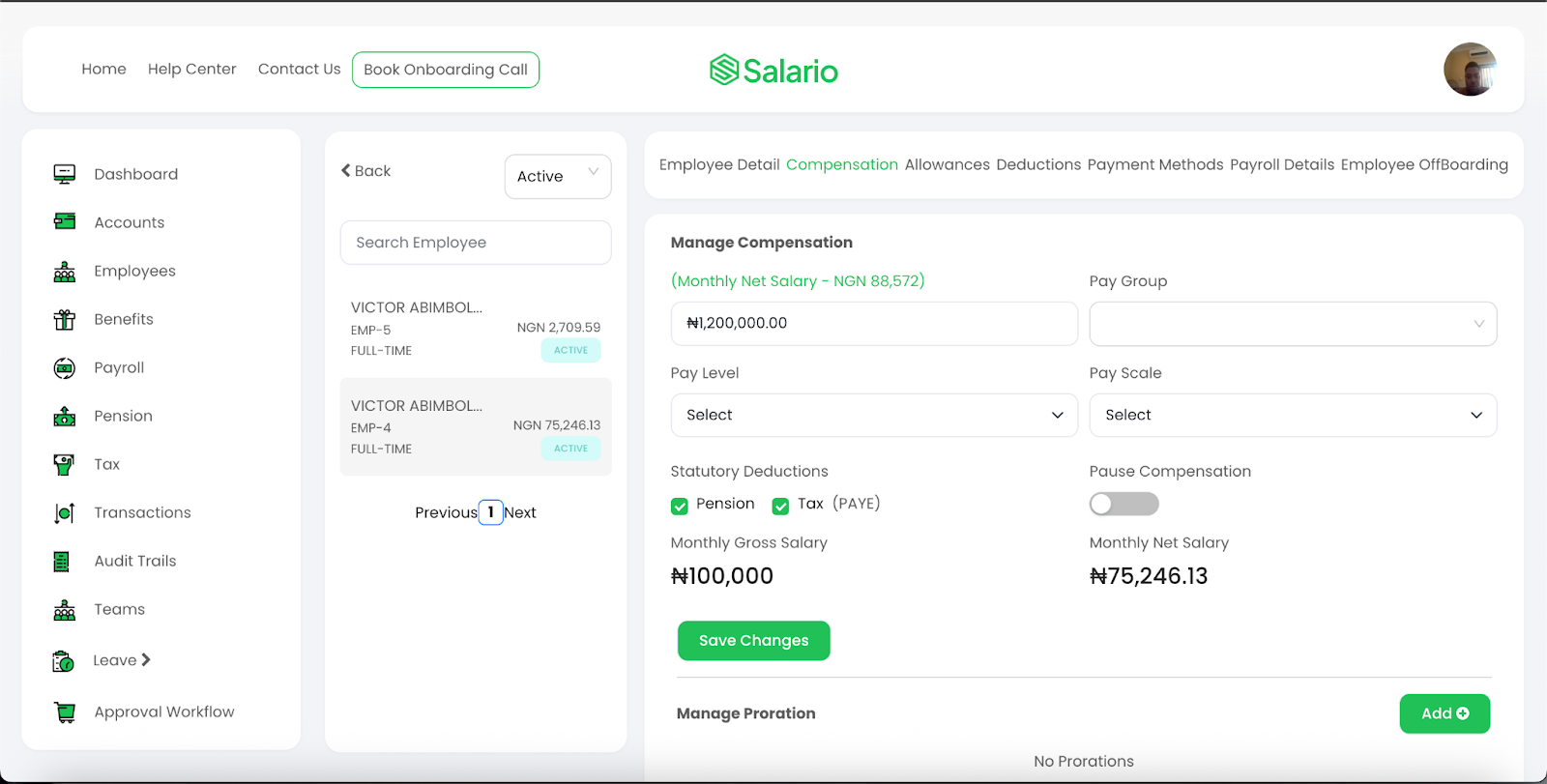

Automate Payroll Computation with Reimbursement Using Salario

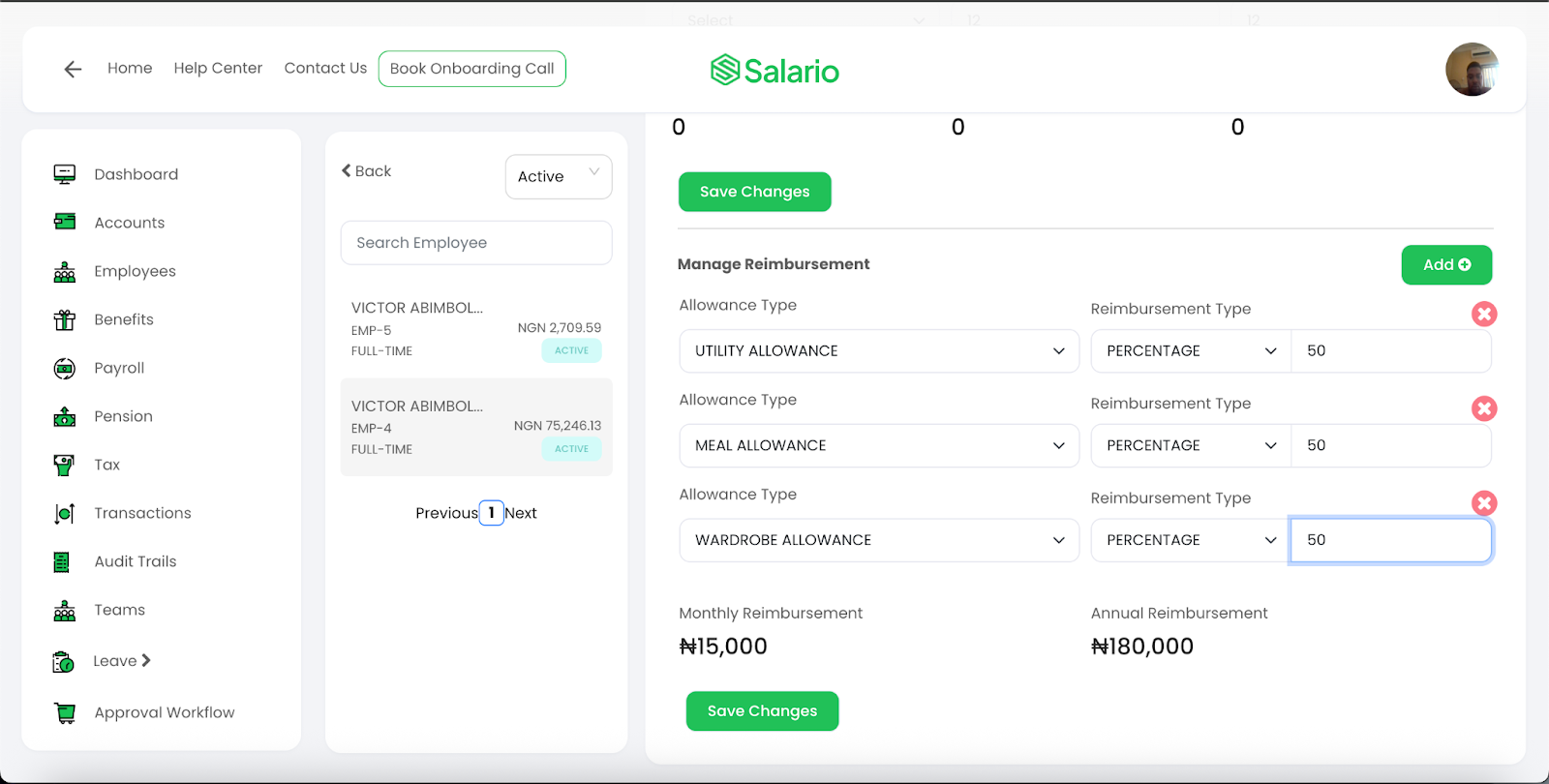

Manually structuring payroll to optimize employee take-home pay can be complex and time-consuming. But with Salario, you can automate payroll computations while ensuring compliance and maximizing employee earnings. The screenshot below confirms that Salario computed a monthly net salary of ₦75,246. When a ₦15,000 reimbursement is added, the employee’s total earnings amount to ₦90,246, in line with the reimbursement strategy outlined in the manual calculation above.

Here’s How Salario Makes It Easy:

- Set Up Reimbursement for Allowances – Easily configure tax-free reimbursements like meal, utility, and wardrobe allowances.

- Automate Payroll Computation – Instantly calculate PAYE, pension, and take-home pay with our intelligent payroll engine.

- Ensure Compliance – Stay compliant with tax regulations while optimizing employee compensation.

- Generate Detailed Payslips – Provide employees with clear breakdowns of salary, reimbursements, and deductions.

- Seamless Bank Integration – Process salary payments in just a few clicks.

Want to see how Salario can help your business maximize employee earnings effortlessly?

📅 Book a Free Demo Today and experience the power of automated payroll computation!