Payroll processing is an essential part of any business. If your business pays out salaries, you have a payroll management system. There are ways to effectively manage salaries and other benefits, and this is referred to as payroll management. When making a choice for managing payroll, the In-House Payroll vs Outsourcing discussion always pops up.

Picking a payroll management system that works for your business is not a blanket decision; there are certain factors to consider before making a choice. Two popular ways businesses manage their payroll is by doing it in-house or hiring an external agency to manage their payroll. Which one works best for your business? Although it remains a personal decision, these are two options worth considering.

In-House Payroll System.

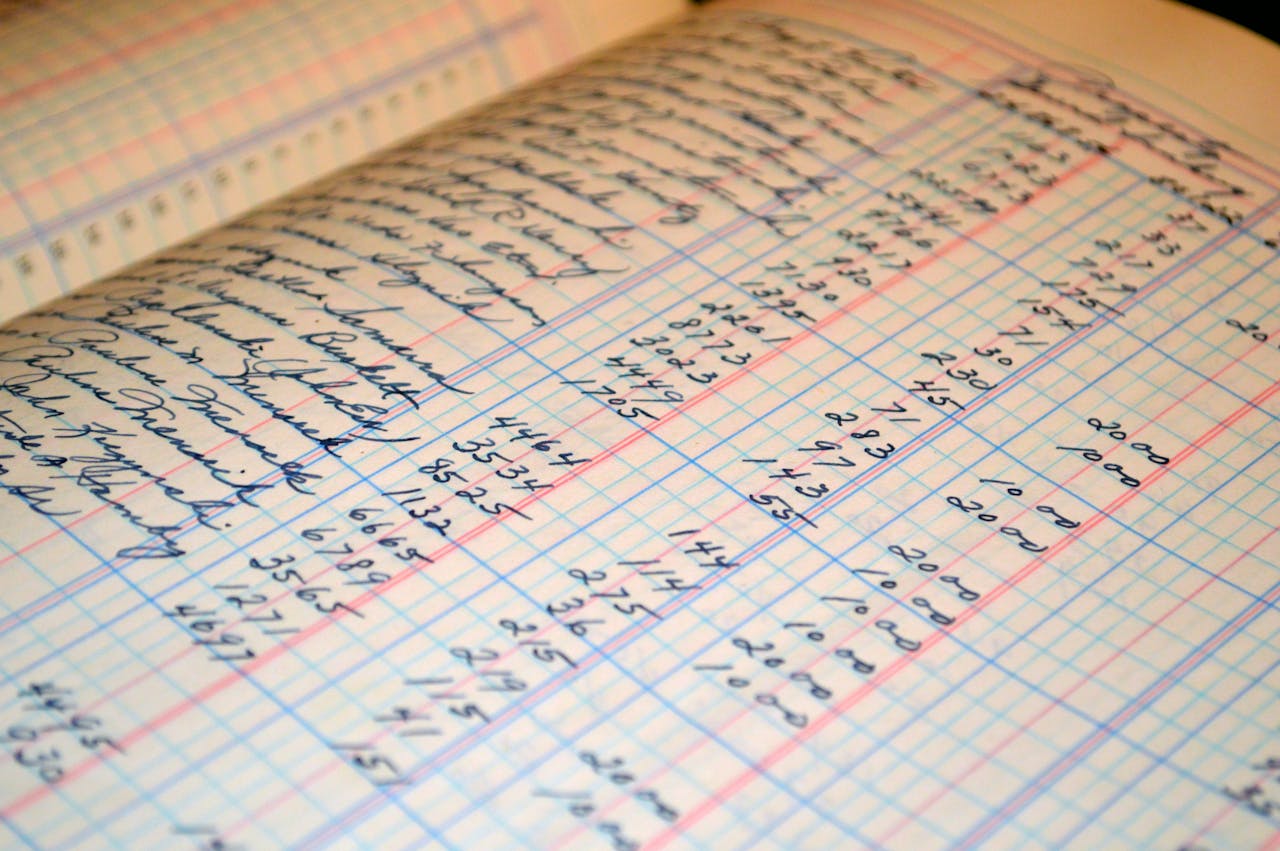

As the name implies, in-house payroll is when the entire payroll management process is conducted within the company. The company sorts this out by hiring a bookkeeper, an HR manager, or an HR team. In-house payroll management can be done manually or through different tools. Both types of systems have advantages and disadvantages.

Pros of In-house payroll system.

- More control and oversight: The in-house payroll option gives your business more control over how its finances are administered, especially regarding your employees. You have more control over who gets what and can make decisions at any time without needing approval from an external body. You can design your payment flow however you feel like it and pick the best option for your business.

- Ease of planning: It becomes easier to plan and execute payroll ahead of time when you have access to all necessary data without relying on or waiting for any external body.

- Data safety and storage: Data security is a valid reason to use an in-house payroll system rather than outsourcing to an agency. While agencies promise confidentiality, and in many cases, they do, it is usually better to have your employees’ data under your control and within your reach rather than relying on external support.

- Employees’ trust: There is nothing better than being trusted by your employees, and this is one key advantage of in-house payroll operations. Since your employees know that their payroll processes are internal, they can easily reach out to the correct department when there are any irregularities, unlike if payroll was managed externally.

Cons of In-house Payroll Systems

- Prone to errors: In-house payroll solutions are more prone to errors because, more often, in-house payroll management is handled by a single person or a really small team compared with agencies whose only duty is to work through payroll.

- Time-consuming: Payroll management is not just about crunching numbers and sending out salaries; there are a lot of data and calculations involved in properly executing payroll processing. Inexperienced hands are bound to make a mess of the whole process, which will cost time and energy, especially when errors are discovered and must be rectified.

- Cost: While it might seem cheap to go in-house, there are hidden costs that are not often acknowledged. Could your team focus on more strategic tasks if payroll was outsourced? While filling positions in your HR or payroll department, take into account the additional expenses associated with hiring, training, and acclimating new employees.

Outsourcing

While in-house payroll management offers a sense of control and familiarity, it has drawbacks. Outsourcing payroll refers to transferring your business’s payroll duties to an external agency of trained and qualified professionals that provide specialist payroll services to companies.

Pros of Outsourcing Payroll

- Expertise and Accuracy: Payroll outsourcing companies specialize in payroll processing, ensuring accuracy and compliance with complex tax regulations. Their dedicated teams possess in-depth knowledge of payroll laws and best practices, minimizing the risk of errors.

- Time and Resource Savings: Businesses can free up valuable time and resources for core operations by entrusting payroll tasks to an external agency. This allows employees to focus on strategic initiatives and enhance overall productivity.

- Cost-Effectiveness: While outsourcing has an initial cost, it can be more cost-effective in the long run. Outsourcing eliminates the need for in-house payroll staff, salaries, benefits, and training expenses.

- Scalability: Outsourcing provides flexibility to accommodate changes in business size and employee numbers. Payroll agencies can quickly scale their services to meet evolving needs without significant overhead costs.

- Reduced Compliance Risks: Payroll outsourcing companies stay current with the latest payroll regulations and ensure compliance with tax laws, reducing the risk of penalties and legal issues.

Cons of Outsourcing Payroll

- Loss of Control: Outsourcing payroll involves relinquishing some control over the process. Businesses may need to rely on the agency’s expertise and communication channels for information and updates.

- Vendor Dependency: Dependence on an external vendor can create risks if the agency experiences disruptions or fails to meet service-level agreements.

- Data Security Concerns: While reputable payroll agencies prioritize data security, there’s always a risk of data breaches or unauthorized access.

- Communication Challenges: Effective communication and coordination between the business and the outsourcing agency are crucial for a successful partnership. If communication channels are not well-established, misunderstandings or delays can arise.

Which choice should you make?

Outsourcing or managing payments in-house depends on your business’s needs. An in-house approach might work for you if you want more control, oversight, and data security and have the money to hire a good team. This choice can be good for small businesses that only need to make basic payments or for companies that would instead handle private employee data themselves.

On the other hand, if your firm is expanding and payroll is getting more complex, outsourcing might let your team concentrate on key business operations. By outsourcing your salary, you can use the skills of professionals to cut down on mistakes and ensure you’re following the constantly changing tax regulations. It’s a flexible option that lets your business grow without hiring and training new people to handle payments.

Before choosing, consider the intricacy of your payroll, available resources, and your company’s strategic goal. There is no one-size-fits-all answer, and what works now might change as your business grows or changes.

In conclusion

The goal is to ensure that the payment process runs smoothly, correctly, and in line with the rules, whether you do it yourself or hire a specialized agency. One gives you power and comfort, while the other gives you knowledge and frees up time you can use more effectively. Ultimately, the best choice is the one that fits your business’s goals and how it works. First, closely examine your resources, your team’s skills, and how complicated your payment needs are. Then, choose the method that will help your business the most.

If you are looking for the best of both worlds, Salario offers a payroll software that gives you in-house control, and the support of an outsourced payroll option. You can take a free demo to see how this fits your business needs