Sarah, a small business owner who had to deal with tax deadlines, confusing insurance lingo, and never-ending spreadsheets, used to feel like she was in a never-ending maze when it came to running payroll and handling benefits. One mistake, like a wrong timesheet or a missing deduction, may lead to a week-long scramble and an angry staff. When a payroll mistake caused an employee’s paycheck to be late, Sarah had to face the painful truth: her manual system couldn’t last. She found out about automation at that point. She not only recovered hours of wasted time by making payroll and benefits administration easier, but she also eliminated expensive mistakes and compliance issues. If you’re stuck in a similar circle, here’s how automation can change the way you handle your money, just like it did for Sarah.

Why Manual Payroll and Benefits Processes Hold You Back

Manual payroll and benefits management might work when you only have a few employees, but as your team grows, so do the risks and complexities. Delays, data entry errors, non-compliance with tax rules, and frustrated employees can all become regular headaches.

Here’s why relying on spreadsheets and fragmented systems isn’t sustainable:

- Error-prone calculations: One wrong formula or missed cell in a spreadsheet can cause incorrect salaries, wrong tax withholdings, or unpaid benefits.

- Time-consuming approvals: Chasing down managers for timesheet sign-offs or benefit selections eats into productive hours.

- Poor employee experience: Staff may feel frustrated with delayed salaries, vague payslips, or unclear benefits policies.

- Compliance risks: Regulatory requirements, from PAYE deductions to pension remittances, can change. Without a system that updates in real-time, you’re exposed to penalties.

- No real-time visibility: Business leaders can’t make informed decisions if they’re working off outdated or manual data.

That’s why learning how to automate payroll and benefits administration is no longer a luxury; it’s a necessity.

What Payroll and Benefits Automation Actually Means

When we discuss automating payroll and benefits administration, we’re not just referring to timely salary disbursements. It’s about using technology to replace repetitive, error-prone tasks with streamlined, intelligent systems that work behind the scenes, saving your HR team hours every week and ensuring every employee gets exactly what they’re owed, when they expect it.

Payroll Automation

Payroll automation includes everything from auto-generating payslips and calculating PAYE, pension, and NHF deductions to syncing with time-tracking tools so employee hours are accurately reflected in monthly wages. These systems ensure compliance with tax and labor laws, reduce manual oversight, and minimize the risk of errors.

Benefit Automation

On the other hand, benefits automation refers to managing all the extras employees receive beyond their salaries, such as health insurance, monthly data bundles, mobile call credits, or even wellness stipends, through centralized workflows. With automation, these benefits can be assigned based on job role, updated company-wide with a few clicks, and tracked in real time for accountability. No more manually adjusting allowances or reconciling with vendors every month.

At its core, automation ensures that your payroll and benefits engine runs quietly, smoothly, and accurately in the background, allowing your team to focus on growth rather than spreadsheets.

Key Tools and Platforms for Payroll Automation

When it comes to automating payroll and benefits, the right tools make all the difference. From full-suite HR software to specialized payroll systems, there are several platforms designed to take the stress out of calculations, disbursements, compliance, and reporting. These tools don’t just digitize payroll, they transform how businesses manage compensation, helping them scale faster and more compliantly.

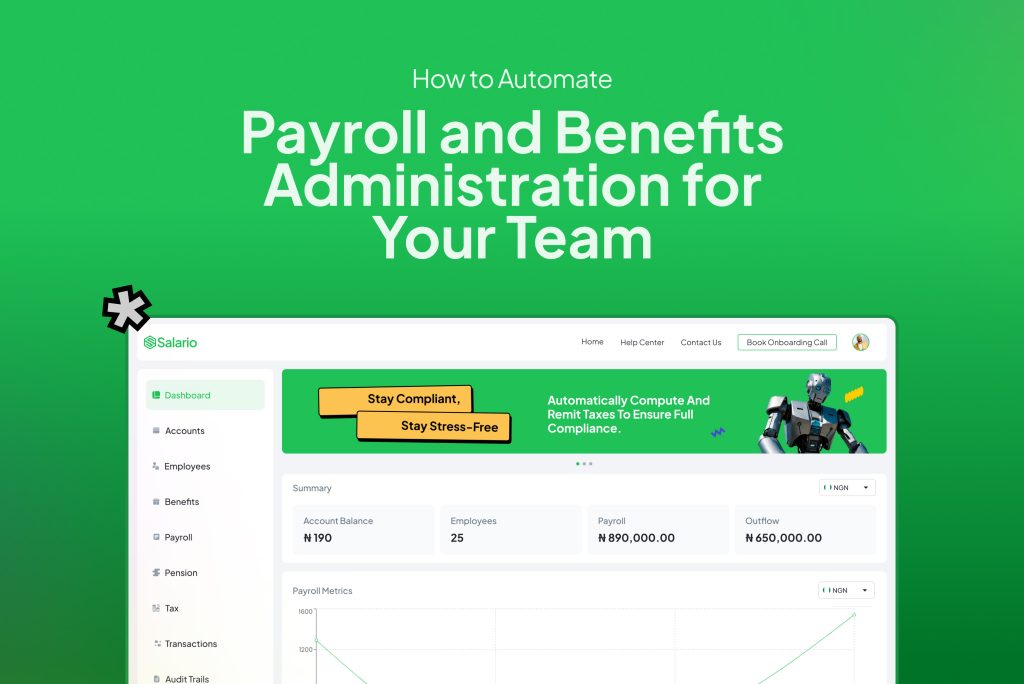

Payroll platforms like Salario, and SeamlessHR offer integrated automation that handles payslip generation, tax deduction calculations, and statutory remittances. These platforms sync employee attendance, leave records, and time-tracking data with salary processing, removing the need for manual reconciliation. Many of them also integrate with accounting tools to ensure clean books at the end of each month.

Benefits management tools, either built into payroll platforms or offered as add-ons, allow companies to assign custom benefits packages based on department, level, or role. For example, employees in the field might automatically receive data stipends, while others receive private health coverage or transport allowances, all managed through rule-based systems. Tools like Zoho People (which integrates with Salario), BambooHR, and Gusto help centralize benefits distribution and reporting, with employee self-service portals to improve transparency.

In the Nigerian context, utilizing a platform with local tax and compliance expertise is crucial. Platforms like Salario not only automate payroll but also factor in local regulations (e.g., PAYE, NHF, Pension, NSITF), ensuring businesses stay compliant without needing an in-house expert.

With the right tools in place, payroll no longer has to be reactive. Instead, it becomes a proactive function that supports employee satisfaction, compliance, and strategic HR growth.

Step-by-Step Guide to Automating Payroll and Benefits

Whether you’re just starting out or transitioning from a manual system, automating payroll and benefits doesn’t have to be overwhelming. Besides , we have a step-by-step guide to help you out. With the right tools and approach, like what Salario offers, you can simplify the process and ensure both compliance and consistency from day one.

Step 1: Evaluate Your Current Payroll and Benefits Workflow

Before switching to automation, map out how payroll and benefits are currently being managed. Identify:

- Pain points (e.g., late payments, calculation errors, scattered records)

- Manual processes that take the most time

- Key compliance obligations you’re struggling to meet

This helps define what you need from an automated solution.

Step 2: Choose a Platform That Understands Local Compliance

In Nigeria, payroll isn’t just about salaries, it includes tax (PAYE), pension, health insurance, and other statutory remittances. Choose a solution like Salario, which is built for the Nigerian context and ensures full statutory compliance without extra input from your team.

Step 3: Digitize Employee Records

Upload accurate employee data, including bank details, tax IDs, salary structures, leave balances, and benefit entitlements. Salario simplifies this process with intuitive onboarding flows and bulk upload features, eliminating data duplication and reducing setup time.

Step 4: Configure Payroll Rules and Benefit Packages

Set up salary components, deduction rules, and payment cycles. You can also customize benefits like healthcare, airtime allowances, or transport support based on role or grade level. Platforms like Salario let you easily configure these parameters and update them whenever policies change.

Step 5: Automate Calculations, Approvals, and Payments

Once set up, the system handles monthly calculations, generates payslips, and enables one-click payment processing. Salario also offers workflow automation, from timesheet approval to benefit disbursement, to ensure no task falls through the cracks.

Step 6: Enable Employee Self-Service

Give employees access to a portal where they can view their payslips, update personal details, and track their benefits. This reduces HR workload and builds transparency. With Salario, employees enjoy a seamless, mobile-friendly interface tailored for day-to-day use.

Step 7: Monitor, Report, and Improve

Use built-in analytics to track payroll costs, benefits uptake, and compliance metrics. Salario’s dashboard gives real-time visibility and generates reports for audits, board reviews, or internal strategy sessions. You can continuously refine policies based on this data.

Benefits of Payroll and Benefits Automation for Employers and Employees

Automating payroll and benefits administration not only streamlines internal processes but also directly enhances the employee experience and reduces compliance risks. Below are some of the most significant benefits for both employers and their teams:

For Employers:

- Time Savings: Automation significantly reduces the time spent on repetitive tasks like data entry, calculations, and tax filings, freeing HR and finance teams to focus on strategy and growth.

- Improved Accuracy: Automated systems reduce human error in salary calculations, deductions, and benefits allocation, minimizing disputes and correction cycles.

- Regulatory Compliance: Platforms that understand local laws (like Nigeria’s PAYE, pension, NHF, NSITF) ensure accurate statutory remittance and reporting, helping businesses avoid penalties.

- Cost Efficiency: By reducing reliance on external consultants and minimizing costly errors, automation lowers administrative overhead.

- Scalability: Automated systems enable the quick and consistent onboarding of new staff, even across multiple locations or countries.

For Employees:

- Timely Payments: Automation ensures employees are paid correctly and on time, improving trust and job satisfaction.

- Transparency: Employees can easily view payslips, tax breakdowns, and benefits packages through self-service portals, reducing confusion and dependency on HR.

- Customized Benefits Access: Automation enables personalized benefit offerings tailored to role, location, or seniority (e.g., data stipends, healthcare coverage, transportation support).

- Error Resolution: Mistakes are rare and often flagged automatically, leading to quicker resolutions when they do occur.

- Greater Confidence: Knowing that payroll and benefits are handled reliably reduces financial anxiety for employees and boosts morale.

Common Automation Challenges and Solutions

Payroll and benefits automation can be very useful, but it can also be hard to set up, especially for companies that are moving from spreadsheets or systems that aren’t connected well. The good news is that these problems can usually be fixed, especially with tools like Salario that are made to work with Nigerian businesses.

Challenges Businesses Face with Payroll and Benefits Automation

Data Migration Headaches

Moving from manual records or legacy software can lead to data errors, missing employee details, or misaligned payroll schedules.

Inadequate Localization

Many global platforms don’t understand local tax laws, statutory remittances, or common Nigerian benefits like airtime/data allowances, leading to compliance risks.

Resistance to Change from Staff

HR teams and finance departments accustomed to manual control might resist automated systems, fearing a loss of oversight or increased complexity.

Integration Gaps

When your payroll system doesn’t sync with other HR tools (e.g., leave management, performance reviews), it creates operational silos and double work.

Unclear Audit Trails or Reporting Issues

Some systems lack clear visibility into how calculations were made, making audits and reconciliations difficult.

Smart Solutions That Actually Work

Start with Clean Data and Expert Support

Use a platform like Salario that offers onboarding support, including data validation and migration services, to ensure a smooth transition.

Choose a Nigeria-first Solution

Avoid compliance pitfalls by selecting tools built with Nigerian laws and HR culture in mind. Salario supports PAYE, pensions, NHF, and even flexible local benefits out of the box.

Train Your Team with Intuitive Tools

Platforms that prioritize user experience, like Salario’s simple, mobile-friendly dashboards, make adoption easier and reduce resistance from teams.

Prioritize Integration and Scalability

Ensure your chosen platform can integrate with your attendance, leave, and performance tools. Salario already integrates with solutions like Zoho People, with more on the way.

Ensure Transparent Reporting and Audit Readiness

Look for systems with robust, real-time reporting. Salario lets you trace every deduction, benefit, or approval across your payroll cycle, making audits painless and building trust with employees.

Conclusion: Your Path Forward

When all is said and done, the art of automating payroll and benefits becomes straightforward and retains its relevance. Being able to promptly deliver on monthly or periodic payments protects your business, and ensures employee long-term loyalty. Whether you’re managing a growing startup or a distributed workforce, automation helps you focus less on manual errors and more on what matters: your people and your business goals.

If you’re ready to simplify payroll, streamline benefits, and confidently meet Nigeria’s compliance demands, Salario is here to help. With localized features, seamless integrations, and human support every step of the way, Salario equips your business to grow without the chaos.

Book a free demo today and see how effortless payroll and HR can be when built with your team in mind.