As technology advances, businesses increasingly rely on specialized payroll and HR management platforms to streamline their operations. With many options available, it can be challenging to identify which is the right fit for your organization’s needs. Two platforms often discussed in this space are WorkPay vs PaidHR. Both offer a range of features designed to simplify payroll tasks, improve compliance, and enhance overall workforce management. Yet, there are subtle differences in their capabilities, pricing, and user experience which can significantly impact how well they integrate with a company’s workflows.

In this comparison, we’ll examine each platform’s approach to payroll processing, compliance support, benefits management, user experience, integrations, and pricing models. By the end, you will have a clearer perspective on which solution may better align with your business objective, and why other providers, such as Salario, offer much more beneficial options.

WorkPay vs PaidHR: Payroll Processing and Automation

WorkPay places a strong emphasis on automating routine payroll runs. From calculating wages and deductions to facilitating direct deposits, it focuses on reducing manual data entry to save time and cut down on errors. The platform ensures that tax withholding and pay distribution run on a set schedule, which can be convenient for organizations looking to lessen administrative burdens. It’s an attempt to simplify a historically complex process, allowing business owners and HR teams to concentrate on tasks that bring more value than number-crunching.

PaidHR similarly offers automated payroll processing, but its approach leans toward balancing efficiency with flexibility. While it provides standard features such as automated pay runs and accurate tax calculations, PaidHR also emphasizes configurability. For instance, companies with custom pay cycles or different payroll groupings may find that the platform can be easily reconfigured to meet these specific requirements. This can particularly appeal to businesses expecting to scale or those that must handle specialized compensation structures.

WorkPay vs PaidHR: Compliance and Tax Management

WorkPay focuses on making tax filing and compliance less of a headache. By incorporating up-to-date tax tables and automating required filings at federal, state, and local levels, it aims to minimize the risk of penalties. The platform’s approach to compliance is straightforward: keep track of legal changes and integrate them automatically. WorkPay’s built-in compliance logic can be a much-needed relief for smaller organizations that dread the complexity of shifting regulations. It turns payroll operations into a more stable, predictable process.

PaidHR matches many of these compliance capabilities but frames them as part of a more comprehensive HR and payroll ecosystem. The platform’s compliance functions are integrated with broader HR tasks, such as handling new hires, terminations, and benefits deductions. This integration can ensure that compliance isn’t just about timely tax filing but also about consistent record-keeping, proper onboarding workflows and handling deductions correctly. PaidHR’s more holistic compliance approach can create a smoother, more integrated back-office operation for businesses where HR and payroll processes intersect frequently.

WorkPay vs PaidHR: Employee Self-Service and User Experience

WorkPay’s self-service portal for employees is built to reduce HR workload. Staff members can log in to retrieve payslips, check their pay history, and update personal information. This approach streamlines communications and reduces the need for back-and-forth emails between employees and administrators. The platform’s user interface tends to prioritize simplicity, ensuring that employees and HR staff can navigate pay and tax documents without wrestling with complicated menus or excessive steps. This simplicity is a strong selling point for businesses that value straightforward, predictable workflows.

PaidHR also offers employee self-service features, but here the user experience aims at greater customization. While employees can still access pay details and relevant documents easily, PaidHR encourages organizations to adjust what employees see and can do within the portal. This might mean customizing dashboards by role, setting certain permissions for managers, or integrating attendance tracking that connects directly to payroll. The platform aspires to give businesses more control over how they present payroll information, enabling a tailored experience that can adapt as a company’s operational needs evolve.

WorkPay vs PaidHR: Benefits Management and HR Capabilities

WorkPay includes some basic HR functions and may allow integration with benefits packages, though its benefits management tends to remain relatively standard. For a company seeking a simple solution to run payroll, provide health or retirement plans, and track time off, WorkPay’s offerings may suffice. However, if a firm desires a rich set of benefits features—such as the ability to customize plans, integrate multiple providers, or run more complex leave policies—the platform might feel limited. WorkPay keeps benefits handling straightforward and stable, but less advanced when it comes to complexity.

PaidHR, by contrast, strives to incorporate benefits management more deeply. Businesses can align benefits administration with payroll cycles, ensuring that deductions are handled precisely. PaidHR supports more nuanced benefit configurations and can integrate seamlessly with a range of insurance providers or retirement plan administrators. For organizations that view benefits as a strategic part of their overall employee value proposition—rather than just an add-on—PaidHR delivers the depth of functionality required to keep everything running smoothly. This level of detail and adaptability might be particularly relevant for companies with a diverse workforce or multi-location operations where benefit needs differ across teams.

WorkPay vs PaidHR: Integrations and Extensibility

WorkPay, in many cases, provides the core integrations needed to link payroll data to accounting or tax software. Its approach typically emphasizes reliable connections to essential third-party systems. The result is a stable backbone that can support most small to medium-sized businesses. By keeping things simple, WorkPay reduces the complexity that can come from managing multiple software solutions. Organizations that operate with a few key integrations will find WorkPay’s approach more than adequate. However, those expecting to expand their toolset or tie payroll data into more sophisticated analytics platforms may find the range of supported integrations somewhat limited.

PaidHR, on the other hand, tends to position itself as a more open-ended solution. While it doesn’t abandon simplicity, it pushes further in allowing businesses to connect payroll data with different HR, finance, and productivity tools. If a company wants to link advanced time-tracking systems, performance management solutions, or custom finance applications, PaidHR offers a more extensive suite of integrations. This adaptability helps organizations future-proof their payroll infrastructure. As a business’s operational environment changes, users of PaidHR are more likely to scale and adjust without requiring a total system overhaul.

WorkPay vs PaidHR: Pricing Models and Scalability

WorkPay usually adopts a straightforward pricing model, often a base monthly subscription plus a per-employee fee. This simple and predictable pricing structure is helpful for business owners who want to keep costs under control. For smaller teams or those without elaborate requirements, knowing exactly what the platform will cost each month can aid in budgeting. The trade-off is that this straightforward approach may not offer the flexibility or advanced feature sets that more complex organizations need. If your company’s size and needs remain relatively consistent, WorkPay’s pricing approach is a clear advantage. Essentially there are three available plans although no price is attached to each plan:

- Launch: For businesses that are just getting started with payroll automation

- Grow: For growing businesses with advanced automation and employee engagement

- Outsource: For organizations that need payroll and statutory compliance on autopilot

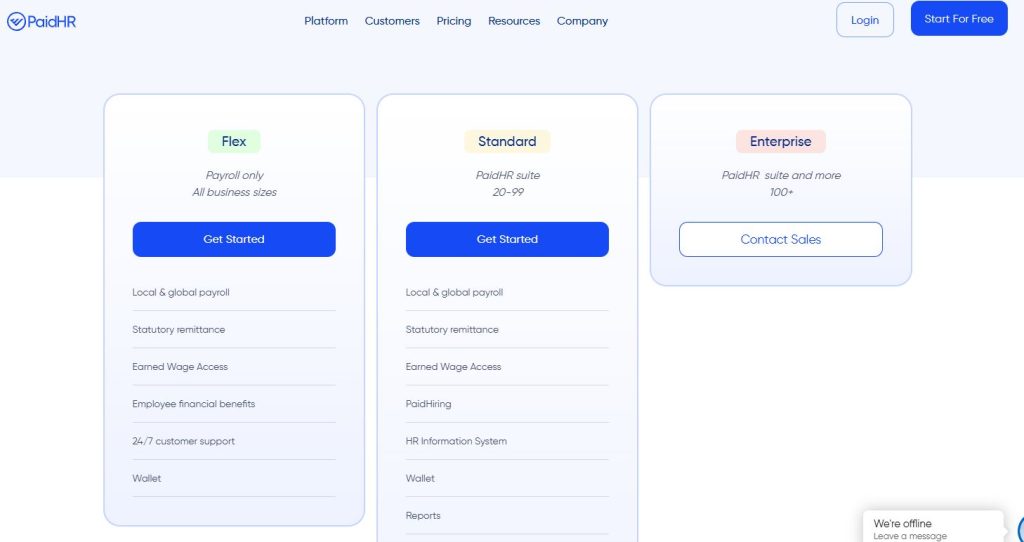

PaidHR’s pricing often involves a similar base-plus-per-employee framework, but businesses can typically add or remove functionality as they grow. This flexibility can help companies avoid outgrowing their payroll platform. For firms expecting rapid expansion, needing advanced integrations, or planning to customize their HR and payroll processes, having a more adaptive pricing structure can prove beneficial. The initial cost may be slightly higher if you need premium features, but the long-term value lies in the platform’s ability to evolve alongside your business. Although no specific pricing is mentioned for any of the plans, there are essentially three to choose from:

- Flex: Payroll Only

- Standard: Payroll and Hr services

- Enterprise: Payroll, HR and more.

Who They Suit Best

WorkPay is a strong contender for smaller organizations or those that want to keep payroll as simple and time-efficient as possible. If a company has a straightforward pay structure, limited benefit programs and just requires the basics to be done right, WorkPay provides a reliable and understandable path forward. Its features make sense for those who prefer minimal complexity and a predictable monthly outlay. For businesses seeking a stable, no-nonsense payroll engine without diving into intricate HR tasks or complex integrations, WorkPay hits that sweet spot.

PaidHR, in contrast, suits businesses that anticipate growth or value the ability to adapt their workflows over time. If your organization wants greater control over payroll segmentation, requires deep benefit management options, needs to integrate with a variety of third-party applications, or plans to scale in both workforce size and complexity, PaidHR’s flexibility is more aligned with those goals. It’s a platform designed for those who consider HR and payroll a strategic function rather than a basic, administrative necessity. Companies that view their internal operations as an evolving part of their competitive strategy will appreciate PaidHR’s adaptability.

Considering Other Options

In comparing WorkPay and PaidHR highlights key differences in user experience, compliance management, integration scope, and adaptability, it’s also worth noting that the payroll software landscape continues to expand. Tools that combine robust HR functionality with payroll accuracy are shaping the way businesses handle their back-office tasks. Modern payroll solutions must leverage automation, reporting analytics, and integrated compliance to create a more strategic approach to workforce management. In this evolving business ecosystem, relying solely on standard payroll features may limit your organization’s potential.

This is where broader market offerings come into play. Providers like Salario have built solutions that emphasize both payroll precision and a forward-looking integration of HR technology. As seen in today’s business environment, where AI and automation are becoming essential for improving accuracy, compliance, and efficiency, modern platforms must deliver more than just a paycheck. They must help leaders understand workforce trends, support strategic decision-making, and reduce the administrative load on HR staff so they can focus on higher-value initiatives. HR and payroll services are no longer distinct categories; the best platforms are bridging these gaps and helping companies navigate the complex terrain where technology, compliance, and human capital intersect.

Conclusion: Aligning with a Forward-Looking Provider

WorkPay and PaidHR both have merits depending on the organization’s immediate needs and growth plans. WorkPay is a solid fit for simplicity and straightforward operations, while PaidHR offers a more flexible approach for those expecting to expand their HR capabilities over time. Yet, considering the constant evolution of payroll technology, businesses may find it wise to select a platform that is not just sufficient for today but is prepared for tomorrow’s challenges.

Salario stands out as an option for those looking beyond baseline features, offering a modernized approach that keeps pace with regulatory changes, integrates seamlessly with a broad range of HR tools, and leans into ongoing innovation. It addresses the core payroll functions with accuracy and speed, while also equipping businesses with the tools necessary to thrive in an era where HR operations and payroll systems must work hand in hand. If you’re searching for a payroll software solution that respects the complexity of your needs and looks ahead to the future of HR and payroll services, Salario is well positioned to serve as an excellent choice.