Odoo HR helps Nigerian businesses in managing employee records, attendance, and leave. Businesses appreciate how it keeps everything organized in one place. But when it comes to payroll, it falls short for Nigerian operations. Local rules like PAYE taxes, NHF contributions, and pension remittances require precise handling that Odoo doesn’t provide. This leaves many SMEs struggling with manual payroll processing, and for Odoo HR users, how to set up payroll for Odoo HR in Nigeria becomes a daily struggle.

Setting up payroll for Odoo HR in Nigeria becomes a real challenge without the right integration. Most Nigerian businesses need a solution that automates compliance, syncs employee data seamlessly, and handles Nigerian-specific deductions without extra stress. That’s where Salario steps in. By connecting Odoo HR with Salario, you get a unified system that processes compliant payroll effortlessly without disrupting your workflows. In this guide, we’ll walk through the setup process step by step, so you can see how to set up payroll for Odoo HR in Nigeria and why Salario makes it simple.

Understanding Odoo HR’s Limitations in Nigeria

Odoo HR serves core HR functions, like tracking employee profiles, attendance, and time off. It’s modular, so you can customize it to fit your business needs. However, when payroll enters the picture, it can become difficult and stressful for Nigerian users. Odoo doesn’t have built-in payroll support for local requirements, such as PAYE withholding, NHF deductions at 2.5% of basic salary, or pension contributions under the Pension Reform Act. Without these, businesses must rely on manual adjustments or external spreadsheets, which often open doors to errors and delays.

For SMEs, this means wasted time and potential fines that strain limited budgets. How to set up payroll for Odoo HR in Nigeria requires a bridge between Odoo’s HR strengths and Nigeria’s payroll realities. Salario fills this void with a dedicated integration, allowing Odoo users to automate their payroll process, from employee data sync to salary payments. No more jumping between tools or double-checking calculations. Instead, you get a seamless flow that keeps your operations running smoothly.

Benefits of Integrating Salario with Odoo HR

Before diving into the set-up, let’s look at why this integration matters for Nigerian businesses. Odoo HR handles employee management well, but payroll is where it needs help. Salario brings Nigerian expertise by automating tasks that Odoo HR can’t. The result of this integration is a complete system where HR data from Odoo flows directly into compliant payroll runs.

Saves Time

By automating payroll processes, Salario helps businesses save several hours spent on manual processes. It automates payroll processes, including salary disbursement, payslip generation, tax and pension deduction, and remittance, thereby saving time and reducing HR queries.

Error Reduction

Salario provides real-time data sync and automated deductions to reduce mistakes, ensuring accurate payments and compliance every time. With Salario’s automation, you do not have to deal with exhaustive lengths of spreadsheets trying to check for errors in employee’s data or their payslip.

Local Compliance

Through Salario’s expertise in Nigeria’s ever changing local regulations, it handles PAYE, NHF, and pension rules, keeping you compliant with FIRS and PenCom without additional stress. Salario helps businesses to avoid fines and penalties by timely remission of taxes and pensions.

Employee Satisfaction

With Salario, employees get to enjoy self-service portals that give 24/7 access to payslips and benefits, which helps to reduce HR queries. Timely payments of salaries and benefits with Salario also helps to keep employees satisfied and promote a positive work environment.

Scalability

Salario provides scalable solutions for Nigerian businesses regardless of the size. With its free account, and different affordable pricing options for businesses to choose from according to their feature needs. You can start small, and upgrade as your business grows, and the need for more advanced features increases.

Overall, the integration keeps Odoo’s workflow intact while adding Salario’s payroll power. It’s ideal for SMEs wanting efficiency without disrupting their workflow. These benefits make Salario the go-to for how to set up payroll for Odoo HR in Nigeria, turning complexity into simplicity. Now, let’s get to how to set up payroll for Odoo HR in Nigeria with Salario.

Step-by-Step Guide to Setting Up Payroll for Odoo HR in Nigeria with Salario

Setting up payroll in Odoo HR for Nigerian businesses starts with the right integration. Salario makes this straightforward, bridging Odoo’s HR capabilities with local payroll needs. Follow these steps to get started.

Step 1: Connect Odoo HR to Salario

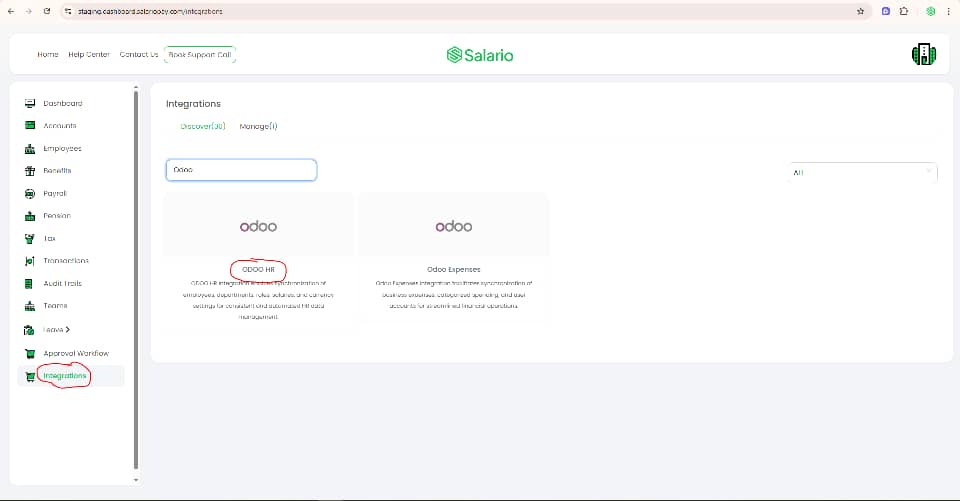

- Log into your Salario account and navigate to the Integrations menu on the left sidebar.

- Search for “Odoo HR” in the available apps list and select it.

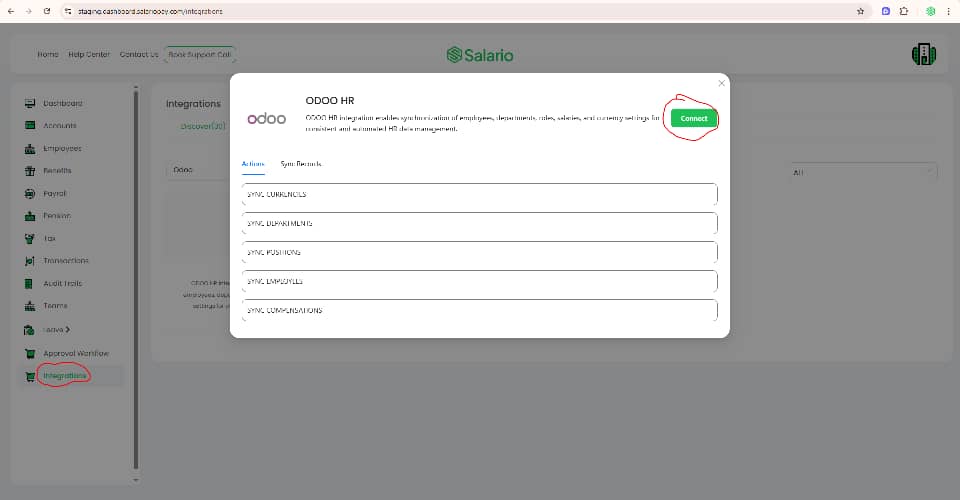

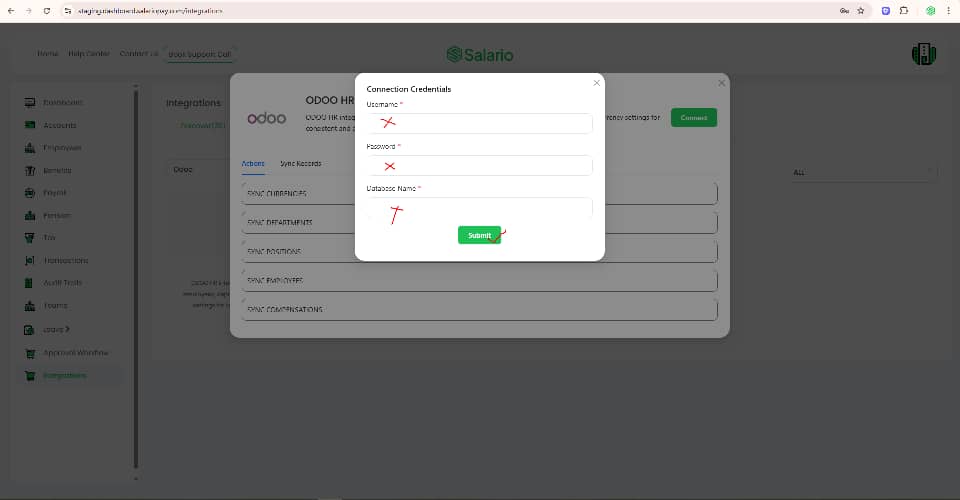

- Click “Connect” and enter your Odoo credentials.

- Review the consent screen to grant Salario access.

- Click “Proceed” to complete the connection.

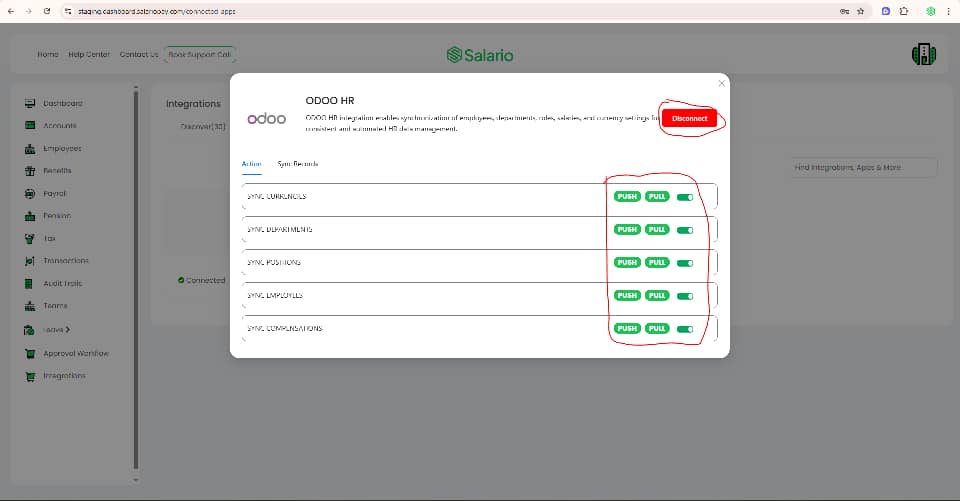

- Once approved, the connection will be established.

This step takes just a few minutes and sets the foundation for automated payroll.

Step 2: Sync Employee Data

With the connection successfully established , Salario automatically imports key data from Odoo HR. This includes:

- Departments

- Positions

- Currencies

- Employees

- Profiles

- Compensation information.

You can also run manual syncs (PUSH or PULL) to update data between 0doo HR and Salario at any time. This step ensures how to set up payroll for Odoo HR in Nigeria is seamless, with data flowing effortlessly between both platforms.

Step 3: Prepare Payroll in Salario

- Now that data is synced, head to the Payroll section in Salario.

- Click “Create Payroll” to start a new run.

- Select the following details:

- Start Date

- End Date

- Payroll Account

- Payroll Type (e.g., Salary, Reimbursement, Leave)

- Click “Continue” to view the payroll summary

- Review all the details carefully

- If everything looks correct, click “Create Payroll”

Step 4: Run the Created Payroll

- Locate the prepared payroll in the list.

- Click “Actions” and select “Run Payroll” to process payments.

- From the “Actions” dropdown, you can also:

- View payroll details

- Update payroll

- Delete payroll (If it hasn’t been run)

If issues arise, Salario’s support team is always available to assist, but the automation minimizes problems. This final step completes how to set up payroll for Odoo HR in Nigeria, delivering results without the usual headaches.

How Salario Solves Odoo HR Payroll Challenges

Salario’s integration with Odoo HR eliminates the paperwork in Nigerian payroll. It automates everything from data sync to payment disbursement, ensuring compliance without unnecessary headaches. For instance, Salario applies PAYE rates based on income brackets and calculates NHF accurately, features Odoo doesn’t have natively. Payslips include all required details, from gross pay to net, formatted for FIRS audits.

A Nigerian tech firm using Odoo HR integrated Salario was able to cut down on the amount of time spent on payroll runs with zero errors. Salario’s self-service portals let employees view payslips anytime, boosting satisfaction.

By solving these pain points, Salario makes setting up payroll for Odoo HR in Nigeria not just possible, but efficient and cost-effective. It’s the perfect complement for Odoo users ready to scale.

Why Choose Salario for Odoo HR Payroll in Nigeria

Salario isn’t just an integration; it’s a complete payroll solution built for Nigerian businesses. It addresses the payroll limitations of Odoo HR, like statutory deductions and pension remittances, while keeping your HR data secure and up to date. The setup is quick and stress free, and the results are immediate: accurate payslips, compliant payments, and happy employees.

For SMEs, Salario’s pricing is affordable, with a free account option for small businesses. As your business grows, you can upgrade for more advanced features as the need may be. Setting up payroll for Odoo HR in Nigeria with Salario is faster and more reliable, which means less worry and more focus on what matters, which is growing your business.

How to Get Started with Salario

Setting up payroll for Odoo HR in Nigeria is easy with Salario:

- Jump on a free demo call with the team

- Create your account

- Connect Odoo HR through your dashboard.

- Import employee data and run your first payroll in minutes.

If you’re tired of managing spreadsheets, worrying about compliance mistakes, or dedicating hours to aligning HR and payroll, Salario offers a straightforward, locally tailored solution.

Conclusion

Setting up payroll for Odoo HR in Nigeria doesn’t have to be stressful. With Salario’s integration, you get to automate compliance, sync data, and run payments smoothly, from preparation to execution. This guide has shown how to set up payroll for Odoo HR in Nigeria step by step, solving the gaps in Odoo’s capabilities. Whether you’re dealing with PAYE complexities or pension rules, Salario makes it simple and stress-free. As a business owner or HR manager looking for a solution for all your payroll concerns, Salario is your best bet! For Odoo HR users, you don’t have to disrupt your workflow just to automate your payroll process. Start your seamless payroll journey today by booking a demo to speak with our team and integrate with Salario. You’ll be amazed at how seamless the process is!