Managing employee compensation in Nigeria is no longer a one-size-fits-all process. As businesses evolve and employee expectations shift, tools like Earnipay have emerged to offer flexible salary access and payroll solutions. But while Earnipay may be a solid option, it’s not the only one on the market. Whether you’re looking for more features, better integration with your HR stack, or pricing that aligns with your business stage, exploring the best Earnipay alternatives could be a smart move.

In this guide, we highlight 5 Earnipay alternatives that Nigerian businesses should consider, whether you’re a startup trying to stay lean or a fast-scaling company building a future-ready workforce. From payroll automation to on-demand salary access and compliance support, these platforms provide compelling features that can help you better manage your team and stay competitive in Nigeria’s dynamic business landscape.

- Cadana (Best for On‑Demand Salary Access with Payroll Automation)

Cadana is a prominent player in Nigeria’s payroll-tech space, offering a slick platform that combines on-demand salary access with automated payroll features. If your business wants to give employees early access to earned wages without complicating your pay cycle, Cadana shines here. Its solution is popular among startups and SMEs that value liquidity flexibility and modern HR perks.

Beyond payday advances, Cadana handles regular payroll functions like salary calculations, statutory deductions (PAYE, NHF, and pension), and bulk payments. The platform integrates with key banking providers in Nigeria, allowing for seamless payment distribution and salary top-ups. For businesses seeking a unified solution that blends Earnipay alternatives with core payroll management, Cadana offers a compelling proposition.

Pros:

- Instant salary advances reduce employee cash-flow stress

- Automates salary runs and payroll-focused compliance

- Smooth integration with local banks for salary distribution

- User‑friendly interface with real-time analytics

Cons:

- Earning-advance fees may affect long-term affordability for employees

- Limited support for full-suite HR features like performance management

- Less focused on structured EOR services or global expansion needs

- SeamlessHR (Best for All-in-One HR and Payroll Management)

SeamlessHR is a comprehensive HR and payroll platform tailored for Nigerian businesses seeking more than just payday features. As an Earnipay alternative, it offers a broad HR toolkit, covering recruitment, attendance, leave management, performance tracking, and full payroll processing, all in one intuitive platform.

On the payroll side, SeamlessHR automates salary calculations, handles statutory deductions like PAYE, NHF, and pensions, and supports bulk payroll disbursements to Nigerian banks. It also provides robust reporting and analytics to help businesses track compliance and performance over time. For managers aiming to centralize HR operations, from hiring and onboarding to salary payouts and performance reviews, SeamlessHR ranks high among tools in the Nigerian market.

Pros:

- Complete suite for HR and payroll in a single platform

- Strong compliance management for statutory deductions

- Useful modules for recruitment, attendance, leave, and performance

- Detailed reporting and dashboard insights

Cons:

- More features may mean a steeper learning curve for smaller teams

- Monthly pricing can add up compared to simpler payroll tools

- Could be overkill for businesses only seeking payday advance features

- NotchHR (Best for Growing Teams That Want Scalable HR + Payroll)

Formerly known as MyXalary, NotchHR is a flexible HR and payroll platform designed for businesses that are outgrowing spreadsheets but aren’t ready for heavyweight enterprise software. It’s a smart pick if you’re exploring Earnipay alternatives for Nigerian businesses and want a tool that combines payroll with everyday HR operations. NotchHR centralizes employee records, supports structured onboarding, and helps HR teams standardize policies across departments as headcount grows.

On the payroll side, NotchHR supports Nigerian statutory deductions (PAYE, pension, NHF), salary approvals, and payslip distribution. Layered on top are HR add-ons like attendance and leave tracking, approval workflows, performance reviews, and KPI dashboards in higher tiers. There’s even a free starter plan for very small teams, which makes it attractive to startups comparing Earnipay alternatives before committing budget.

Pros:

- Tiered feature set that grows with your business

- Nigerian payroll compliance support built in

- HR workflows: leave, attendance, performance (plan dependent)

- Free or low-cost entry tier for small teams testing the platform

Cons:

- Advanced HR modules locked behind higher plans

- Fewer deep integrations than larger, all-in-one suites

- Interface depth may require onboarding for non-HR users

- WorkPay (Best for Regional Payroll & HR Across Africa)

WorkPay is a strong contender among Earnipay alternatives for Nigerian businesses, especially for companies with ambitions beyond one market. Designed by a Kenyan startup, WorkPay offers centralized payroll and HR capabilities across several African countries, including Nigeria, Kenya, Uganda, and Ghana, making it an excellent choice for regional expansion.

On the payroll side, WorkPay automates salary calculations and statutory deductions under Nigerian regulations (PAYE, NHF, pensions), and enables bulk payments to be made directly to local banks. Its HR suite includes attendance tracking, leave management, employee self-service portals, and a clear dashboard to oversee your workforce. For businesses operating across borders in Africa, it provides a seamless solution that seamlessly integrates Nigerian-specific payroll compliance with multi-country visibility.

Pros:

- Pan-African payroll and HR support in one platform

- Aligned with Nigerian statutory requirements

- Strong self-service and attendance/leave features

- Competitive pricing for small to mid-sized enterprises

Cons:

- Less suitable for companies focused solely on Nigeria

- Fewer global integrations compared to larger international HR systems

- Feature complexity may be overkill if cross-border hiring isn’t in your plans

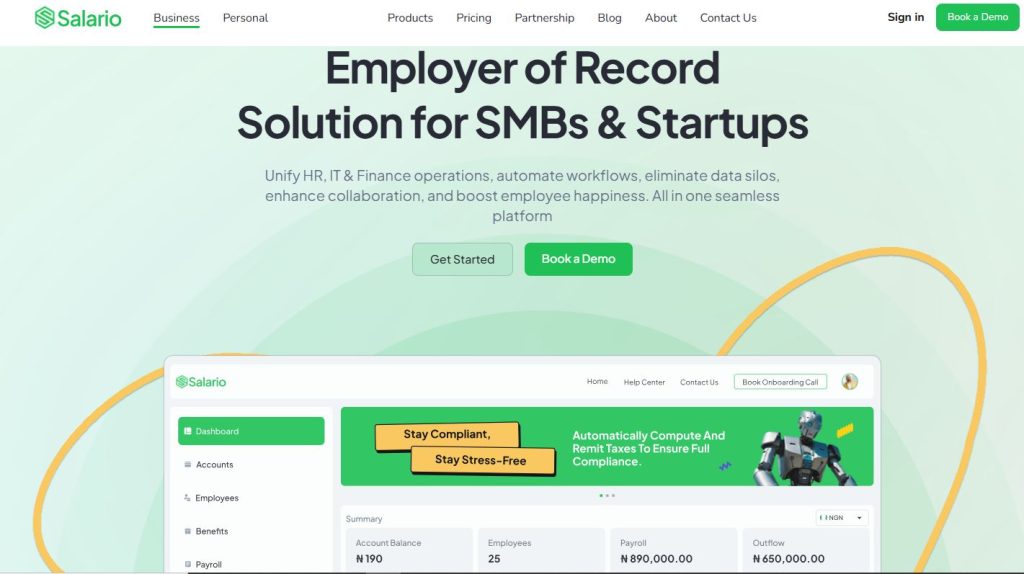

- Salario (Best for Nigeria-Centric HR, Payroll, and Salary Access)

Salario offers a tailored alternative for Nigerian businesses seeking more than just payday flexibility. Designed specifically for the Nigerian market, Salario combines automated payroll, salary advance functionality, and full HR compliance into a single, intuitive platform. It’s a natural pick among Earnipay alternatives for companies looking to gain local insight and depth, without sacrificing modern HR features.

Salario provides on-demand wage access similar to Earnipay, while also handling PAYE, NHF, and pension deductions. Its bulk payment engine supports seamless salary disbursements to Nigerian bank accounts. On the HR side, the platform supports structured onboarding, digital payslips, leave management, performance management, and employee self-service. Plus, Salario integrates with tools like Zoho People, Odoo, and continues to expand integrations to fit into your HRTech stack effortlessly.

Pros:

- Simplifies salary advances with full regulatory compliance

- Deep integration with Nigerian banking and payroll systems

- Combines payroll, HR features, and statutory compliance in one tool

- Integrates with HR tools like Zoho People to streamline workflows

Cons:

- Still focused primarily on Nigeria (not yet pan-African)

- Advanced features like performance management are evolving

- SMEs outside payroll needs might find some features unnecessary

Final Thoughts

While Earnipay alternatives vary widely in focus, Salario stands out for its Nigeria-first approach, combining salary flexibility, deep payroll compliance, and growing HR integrations into a single, accessible platform. Whether you’re a startup or growing business in Lagos, Abuja, Jos or beyond, consider how each tool aligns with your structure, team size, and strategic goals.

Curious which one matches your needs? Book a demo with Salario to explore how it can help you scale payroll and HR smarter in Nigeria.